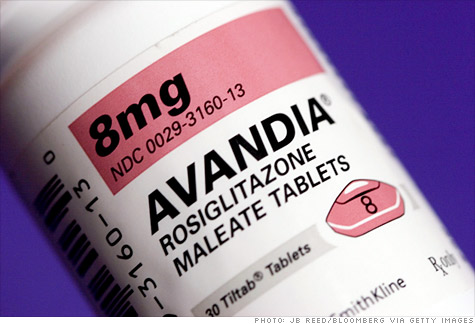

FORTUNE -- GlaxoSmithKline is on the hook for Avandia, a drug that helps diabetes patients regulate blood sugar levels, but also causes heart problems. Critical reviews in major medical journals have repeatedly challenged its safety, and mainstream media have picked up on the studies in scathing articles. GSK has tried to defend the drug from the attacks, but there's only so much the company can do.

Yet the outcry against Avandia's safety issues probably won't reach Glaxo's pocketbook. Unless someone, like one of the thousands of plaintiffs suing Glaxo, (GSK) funds a big, expensive, technically difficult study, the drug-maker is probably in the clear.

Most recently, Avandia has come under fire in the British Medical Journal, which claims the drug never should have reached the market in the UK. The authors outline all of the reasons why the British regulatory body called the European Medicines Agency should pull the drug.

This is the latest of a long history of legal problems for Avandia, starting in 2007 with a study co-authored by a well-known cardiologist Steven Nissan. Nissan looked back at studies that GlaxoSmithKline had done about the efficacy of the drug, and sifted through the data to see if patients taking Avandia had suffered an unusually high rate of heart attacks. He found that they did.

The FDA called the first Avandia advisory panel in 2007. After hearing the panel's advice, the regulator ruled that the drug should stay on the market with more warning labels. The FDA also demanded that GlaxoSmithKline foot the bill for an in-house study to see whether Avandia increased the risk of heart attacks.

Sales of the drug plummeted in 2007, due to the controversy. Revenue has since plateaued, keeping Avandia as a money-maker for Glaxo, raking in a little over a billion dollars a year. That's about a third of the revenue it generated as a top-blockbuster when it was first released in 1999.

In 2009, more evidence cropped up in the case against the drug maker -- some of it suggesting that Glaxo knowingly skewed data that would have revealed Avandia's dangerous side effects. This past July, the FDA assembled a panel of 33 experts to advise whether or not to pull the drug. The recommendation was soft.

"The panel seemed to take the easy way out by just saying, 'label it more and let everybody figure it out,'" says Les Funtleyder a health-care analyst at industrial trading firm Miller Tabak + Co.

Post-patent Avandia

Glaxo will lose its patent for Avandia in 2012, and the company will probably fight for the drug to the end, despite its dangers, because that's simply what drug companies do. Even if Glaxo bowed to reality, throwing in the towel on fighting to extend the patent would probably be fodder for victims' lawsuits. Either way, the fight doesn't make Glaxo look good. "If it turns out to be as dangerous as the people say it is, then Glaxo is just raising the litigation bar in the future," Funtleyder says.

Even after Glaxo eventually loses the patent (all drugs eventually 'go generic' thanks to federal laws meant to lower the price of health care) the company could have to deal with problems discovered about the drug in the future, especially since the Avandia brand will probably stay on the market after 2012.

"They must believe they can weather the storm and still make money," says Robert Green, a pharmaceutical intellectual property lawyer with Leydig, Voit & Mayer.

Glaxo is still making off of Avandia now. Its half-billion dollars in sales last year in sales still translates to almost $1.5 million a day, which should cover legal fees for settling lawsuits. As for weathering the storm, Glaxo is in a good situation, in some ways. The drug has been pummeled for so long that shareholders have numbed to fluctuations in the revenue stream. "I think maybe investors have gotten Avandia distress fatigue," Funtleyder says.

The new paper in the British Medical Journal probably won't jolt them out of it. "You'd actually need something quite a bit more to shock everybody-you almost need a smoking gun," says Funtleyder.

It will be difficult to find one. Even the most damning third-party study, which is Nissan's from 2007, wasn't a controlled trial designed to study to study the drug's risk of causing heart attacks. GlaxoSmithKline never did one before the drug was launched.

You could argue that they should have, but there was no real incentive. It's true that the Actos and Avandia are both derivatives of a drug called troglitazone, which was pulled from the US market in 2000 because it caused liver and heart problems in patients. But the compounds in Actos and Avandia are chemically different enough from troglitazone that there is no legal requirement to study whether they cause similar problems.

Regulators only have weak data by which to make decisions about Avandia. In 2007, the FDA mandated that GlaxoSmithKline design a study to test whether Avandia increased risk for heart attacks. They did, but it was flawed. In an internal memo, FDA official Thomas Marciniak admitted that the FDA did not review the study design before it was launched. "If we had, we would have judged it to be unacceptable."

It's difficult to design a trial to test the effectiveness of diabetes medication. For one, people participating in the trial already have a high risk for heart attacks. "It takes a fairly significant patient study to show there's a nexus between things like increased heart attacks and consumption of the drug," Green says.

You would need a randomized, controlled trial looking at risk of heart problems between two patient groups-one taking Avandia, and a control group taking a regimen of diabetes drugs in a different class. No one has done that. No one probably will.

The closest that could happen is something called the TIDE trial that GlaxoSmithKline started in 2007. It compared Avandia with another drug made from a similar compound, called Actos.

"The TIDE trial is the only ongoing GSK-sponsored clinical trial with rosiglitazone [Avandia's active ingredient]. It is a gold standard, large, controlled, prospective, cardiovascular outcome study comparing rosiglitazone to pioglitazone [Actos] and will provide the best evidence regarding the comparative cardiovascular safety of rosiglitazone and pioglitazone," says Mary Anne Rhyne, the director of US media relations for GSK.

But TIDE is a non-inferiority study. This means that the trial is not designed to test whether one drug is better, but to test whether one drug isn't worse. These trials are weaker. In fact, the Government Accountability Office recently reviewed this study design and found it necessary in some cases, but lacking.

Second, the study compares two drugs of the same class. A study completed by health insurer WellPoint Inc found that both drugs increased the risk of heart attacks in patients by the same rate. The study looked at insurance claims filed by patients, and didn't compare the drugs against a control group receiving a placebo, or to a control group receiving a different treatment regimen. That means a problem with this entire class of drugs would not show up in the study.

Perhaps for these reasons, the FDA halted the TIDE study in July. In the meantime, both drugs are still on the market.

By the time the TIDE trial picks up again, if it does, the results won't come out until after Glaxo loses Avandia. It will be much easier for the company to wean itself off of the money it's making on Avandia when the drug is facing competition from generics.

The window of opportunity to punish Glaxo for marketing a drug with dangerous side effects will also have probably passed. The only hits the company will take is to its reputation, and investors will likely forive all the next time Glaxo can push another blockbusters through its pipeline.

Source URL

No comments:

Post a Comment